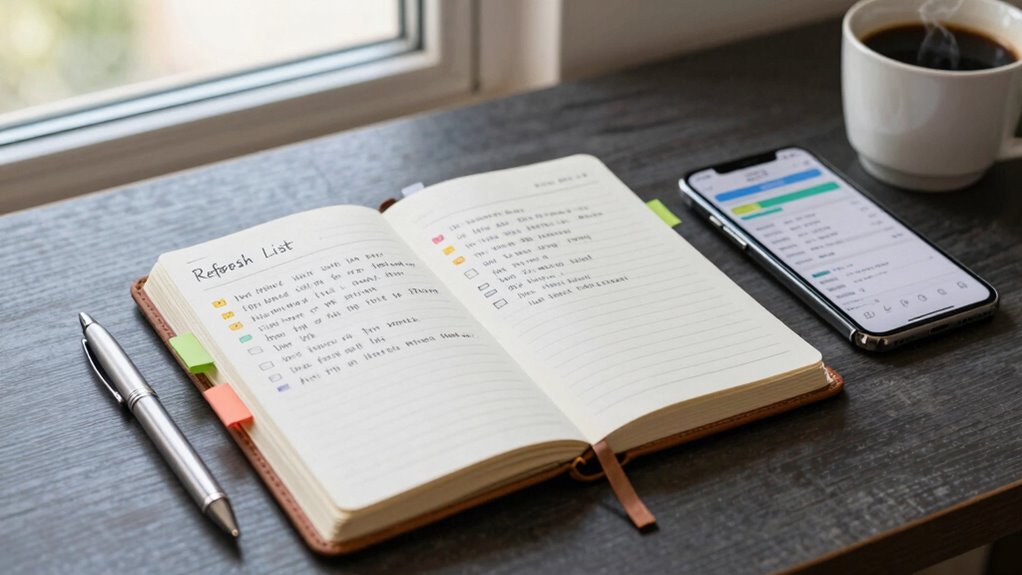

Before spending your first dime, you need a thorough budget refresh list to stay on top of project costs. This list should include all direct expenses like materials, labor, and permits, along with potential price changes or unforeseen charges. Prioritize essential items and identify areas where you can save. By building and regularly updating this list, you’ll avoid surprises and make smarter financial decisions—keeping your project financially healthy from start to finish. Keep going to learn more.

Key Takeaways

- Review all direct and indirect project costs, including materials, labor, permits, and potential fluctuations.

- Categorize expenses into fixed, variable, and discretionary to prioritize spending and identify savings.

- Analyze past spending patterns to detect unnecessary costs and optimize budget allocation.

- Incorporate contingency funds for unforeseen charges and seasonal or variable costs.

- Regularly update and track actual expenditures against the budget to ensure financial accuracy and control.

Why You Need a Budget Refresh List for Your Projects

Have you ever found yourself overspending or missing crucial expenses because your budget wasn’t up-to-date? A budget refresh list helps you stay on top of your project costs by performing a thorough cost analysis. This process reveals where your money is going and highlights areas for potential savings. Regular updates also improve vendor negotiation, giving you leverage to secure better deals or discounts. Without a current budget, you risk underestimating expenses or overcommitting funds, which can derail your project. Updating your budget ensures accuracy and keeps your financial plan aligned with project needs. Staying aware of your project’s cost structure allows for more precise adjustments and better financial control. Incorporating energy-efficient cloud solutions into your budget planning can further optimize costs and promote sustainability. A well-maintained budget refresh list is essential for managing heavy-duty equipment and avoiding unexpected costs. It’s a proactive step that saves you time, money, and stress, enabling you to make smarter decisions and stick to your financial goals.

What Items Should You Include in Your Budget Refresh List?

To guarantee your budget refresh list is thorough, start by including all direct project costs such as materials, labor, and equipment rentals. These are essential for effective cost control and should be categorized under relevant expense categories. Be sure to list every item that contributes to the project’s execution, avoiding overlooked expenses that could disrupt your budget. Include costs for subcontractors, permits, and delivery fees, as these directly impact your project’s financial scope. Also, consider potential price fluctuations or additional charges that might arise. By clearly defining each expense category, you gain better insight into where your money is allocated, helping you manage costs effectively. Incorporating considerations for thermal behavior and heat management ensures your project remains within budget and performs as expected. Additionally, reviewing field‑of‑view requirements and equipment compatibility helps prevent costly adjustments later. Being aware of cost estimation best practices can further improve your budgeting accuracy. A comprehensive list ensures you’re prepared for the real expenses and can make informed decisions before spending a dime, especially when understanding the financial planning involved. Furthermore, integrating connected fitness technology considerations can help identify long-term savings and operational efficiencies.

How Can You Prioritize Expenses and Find Savings?

Wondering how to make the most of your budget? Start by evaluating your expenses through proper categorization. Break your spending into fixed, variable, and discretionary categories. This detailed overview helps you see where your money goes and identify areas to cut back. Prioritize essential expenses like housing, utilities, and supplies to maintain your financial flexibility. Then, look for savings opportunities in non-essential categories, such as dining out or subscriptions. Focus on reducing or eliminating costs that don’t add value to your work or well-being. By clearly categorizing expenses and prioritizing critical items, you can create a strategic plan that maximizes savings without sacrificing your goals. Additionally, understanding the horsepower of electric dirt bikes can help you determine if investing in a high-performance model aligns with your recreational needs. Incorporating financial planning strategies can further support your efforts to balance immediate needs and long-term growth. Recognizing vacuum technology advancements can also help you choose efficient cleaning tools that save time and effort in your daily routine. Exploring best woods for farmhouse tables may also inspire cost-effective upgrades to your home decor.

How to Build and Use Your Budget Refresh List Effectively

Once you’ve categorized your expenses and identified areas for potential savings, the next step is to create a practical Budget Refresh List. This list guides your financial planning and simplifies cost analysis, helping you decide where to cut back or reallocate funds. Using it regularly to stay on top of spending can also reveal spending patterns that inform smarter financial choices. Structuring your list with smart design principles ensures your living space remains both beautiful and functional while aligning with your budget. Incorporating free floating elements into your outdoor spaces can provide flexible design options that adapt to changing needs and preferences. Additionally, applying evidence‑based techniques to your planning process can improve your ability to make informed decisions and optimize your financial outcomes. Incorporating culinary-inspired organization techniques can further streamline your home setup, making it easier to maintain and enjoy.

What Common Mistakes Should You Avoid When Refreshing Your Budget?

Avoiding common mistakes when revitalizing your budget is essential to maintaining financial stability and making meaningful progress. Costly oversights often happen when you neglect to review all expense categories or underestimate variable costs, leading to gaps in your plan. Overlooked details, such as small recurring expenses or seasonal fluctuations, can quickly derail your efforts. Another mistake is updating your budget too infrequently, which causes you to miss trends or overspend in certain areas. Additionally, failing to track actual spending against your refreshed budget can result in unrealistic expectations and financial strain. Staying aware of expense tracking and adjusting regularly is crucial, especially considering how variable costs can unexpectedly impact your financial plans. Regularly reviewing your support breakfast options can help you find cost-effective ways to enjoy your mornings without overspending. By avoiding these pitfalls, you ensure your budget remains accurate, exhaustive, and effective in guiding your financial decisions.

Frequently Asked Questions

How Often Should I Update My Budget Refresh List?

You should update your budget refresh list monthly to stay on top of your financial tracking and expense prioritization. Regular updates help you catch spending patterns, adjust for any changes, and verify your budget remains accurate. By reviewing your list frequently, you can make informed decisions, prevent overspending, and keep your financial goals on track. Consistent updates are essential for maintaining control over your finances and making smart, proactive choices.

What Tools or Software Can Assist in Creating My List?

Did you know 73% of designers find software helpful for accurate cost estimation? To create your list, consider tools like Excel for customizable tracking, or project management apps like Trello or Asana that integrate seamlessly with budgeting software. These tools streamline cost estimation, improve accuracy, and allow easy updates, ensuring your budget refresh list stays current and reliable. Using software makes managing your budget much more efficient and less stressful.

How Do I Handle Unforeseen Expenses During Project Planning?

When unforeseen expenses pop up, you should rely on emergency funds and contingency planning. Keep a designated reserve budget to cover unexpected costs without disrupting your project. Regularly review your budget to identify potential gaps and adjust as needed. Being proactive helps you stay on track, ensuring you’re prepared for surprises and can handle them smoothly without jeopardizing your project’s success.

Can a Budget Refresh List Help Prevent Project Overspending?

A budget refresh list can absolutely prevent project overspending, acting like a safety net that catches costly surprises. By regularly updating your cost estimation and vendor negotiation strategies, you stay ahead of unpredictable expenses. This proactive approach guarantees you won’t be blindsided by hidden costs, keeping your project on track and within budget. Think of it as your financial compass, guiding every dollar with precision and confidence.

What Criteria Determine Which Items Are Most Important to Include?

You determine the most important items through design prioritization and cost analysis. Focus on elements that have the greatest impact on project goals and user experience, while considering your budget constraints. Evaluate each item’s value versus cost, ensuring essential features are prioritized. This approach helps you make informed decisions, allocate resources wisely, and avoid overspending, ultimately leading to a well-balanced, effective project plan.

Conclusion

A budget refresh list keeps you in control and prevents overspending, even if you think your finances are tight. It’s easy to overlook small expenses, but staying proactive with your list guarantees you’re always prepared. Don’t let the fear of extra work hold you back—updating your list regularly actually saves you money in the long run. With a clear plan, you’ll make smarter choices and get the most out of every dollar.